Eliot House highlighted by fall color.

Rose Lincoln/Harvard Staff Photographer

Weathering COVID’s financial storm

Harvard held fiscal-year deficit to $10M, but challenges, uncertainty ahead

The March shutdown for COVID-19 not only disrupted learning and research at Harvard, it had a negative impact on University finances not seen since the 2008 financial crisis, requiring massive, unplanned spending to meet pandemic needs while curtailing revenue-generating activities. As the University prepares to release its annual report this month, Executive Vice President Katie Lapp and Chief Financial Officer and Vice President for Finance Thomas Hollister sat down with the Gazette to discuss the extraordinary final months of the fiscal year that ended in June and the financial pressures facing the University.

Q&A

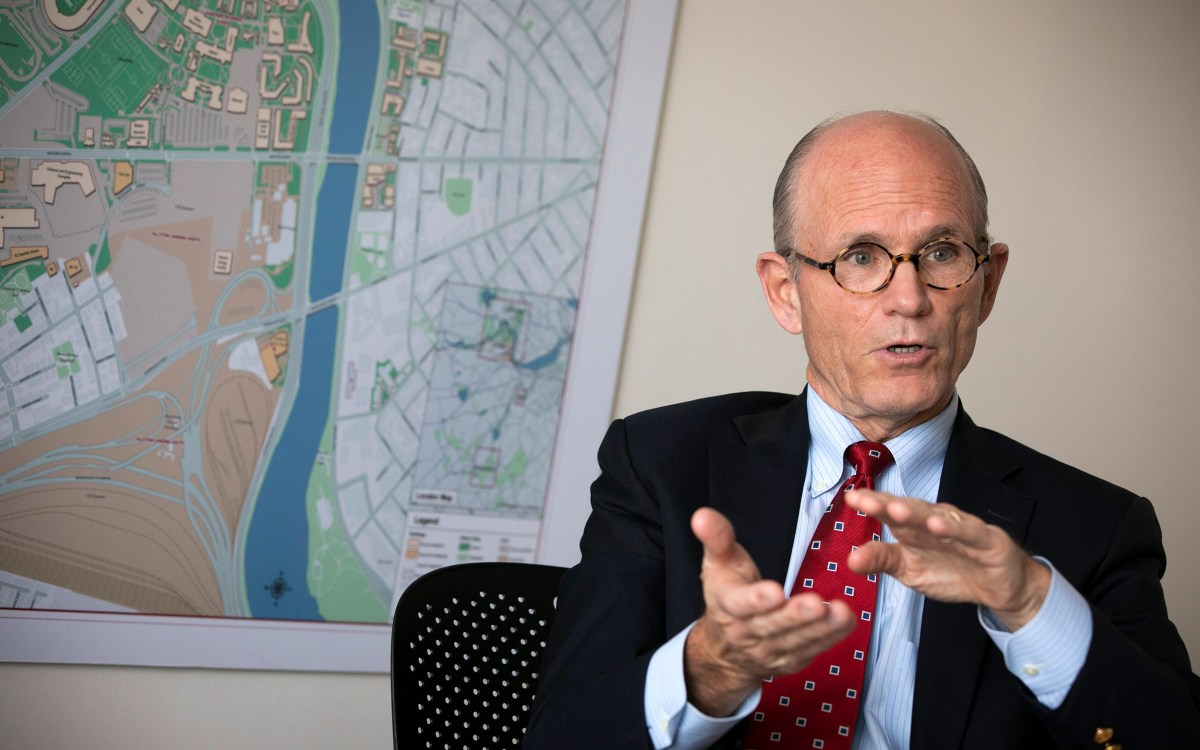

Katie Lapp and Thomas Hollister

GAZETTE: Given the turmoil of the last six months, Harvard’s annual financial report struck a surprisingly positive, albeit cautionary, note. Despite the disruption caused by COVID, including a major decline in revenue, the operating deficit was $10 million on a $5.4 billion budget. How did the University manage that?

LAPP: The results are testament to the strong financial position that the University was in when the COVID pandemic hit. That allowed us to quickly pivot and adapt to a landscape that was changing within three months of the end of the fiscal year. The report documents a $10 million deficit for FY20, but we sustained a $270 million revenue decline from projections that we had made immediately prior to the pandemic. We issued refunds of room and board; we canceled continuing education and executive education programs; we closed research labs and halted a number of other activities that have revenue associated with them.

The University leadership — the Corporation, President [Larry] Bacow, Provost [Alan] Garber, the deans across the Schools, and the vice presidents — put in place cost-control measures that allowed us to address those declines quickly. That included freezing hiring, freezing salaries, and dramatically reducing capital spending. University leadership also took a voluntary pay cut. I would like to give a shoutout to Tom Hollister and his financial team. Only two years ago, they had the foresight — working with the president and our finance committee — to model dramatic financial losses at the University. It was that foresight and the resulting exercise, which all of us went through, that positioned the University quite well to handle the initial crisis.

HOLLISTER: I think it’s worth mentioning the breathtaking speed with which the faculty, the administration, and staff pivoted to remote and hybrid learning and working. Even with closed labs, faculty and staff investigators were finding ways of conducting research. It was astonishing and inspiring.

GAZETTE: Tell us more about the downside planning, the recession playbook. What kind of exercise did people go through as part of this planning process?

HOLLISTER: I think these planning efforts, including the recession playbook, put us in a stronger position on the eve of this pandemic. Larry Bacow, very early in his presidency, said he wasn’t sure when, but he knew there would be a recession during his tenure. I think that insight encouraged the Finance Committee to support building the playbook. It also helped many across the campus have a better sense of how to react. There was a game plan, in essence.

GAZETTE: Was it about prioritizing, thinking about the mission? Or was it a dollars and cents, “We’re going to cut office supplies by half”?

HOLLISTER: It was under the direction of the deans at each of Harvard’s Schools. Each of the affiliates also did scenario planning for their multiyear financial plans and their annual budgeting process, examining how a downturn could impact their operations and what would be their choices in terms of response. It began at a very high level: What do we want to maintain, or even invest in, during a downturn? And in that sense, the focus was to try to be strategic.

LAPP: Scenario planning of this sort is not focused on the absolute details. It’s articulating what your priorities are, what you would preserve, and where you might look to tighten your belt. So, when the actual circumstances hit, you have already gone through that mental process with your team, and you can start getting into the details.

GAZETTE: How does last year’s $308 million surplus relate to this year’s deficit? Was that put away as rainy day funds that can now be used, or is there less of a direct link between last year’s surplus and this year’s deficit?

HOLLISTER: Last year’s University-wide surplus was really a consolidation of results for individual Schools and units. Their surpluses were earned locally and used locally. If they were not invested immediately in the enterprise, they went into reserves and are available exactly for times like these. In some cases, they may have paid down debt, which gives further flexibility. So, past surpluses have clearly been a help. One great strength of our decentralized environment is that those who are best informed and most knowledgeable about their School or their unit are the ones making decisions and know best where the money should go.

GAZETTE: The market’s continued strong performance may seem a bit divorced from the COVID-19 reality, but it helped the endowment become a significant bright spot in the budget picture with a 7.3 percent return and an overall value increasing $1 billion to $41.9 billion. How important is endowment revenue in stabilizing the University’s finances year to year, but especially in times of economic crisis?

HOLLISTER: The endowment provides the largest portion of our revenue through annual distributions into operations. In this past year, it accounted for 37 percent of total revenues. Those funds provide essential support for the teaching and research activities at Harvard and are thanks to Harvard’s incredible donors, both past and present. The strong performance was an excellent outcome in the midst of market volatility. These results place HMC [Harvard Management Company] for the second year in a row at the higher end of endowment returns for large peer universities. Narv Narvekar, the president of HMC, would be the first to say that results should not be measured on a year-to-year basis. But it’s increasingly clear that Narv and his colleagues are making steady progress and demonstrating proficiency and achievements in a variety of ways. Narv’s annual summary letter is in the annual report, and I urge everyone to read it for further information.

GAZETTE: Was there a moment when either of you breathed a sigh of relief when it appeared that the market was not going to stay down the 20 percent or 30 percent it fell to in the spring?

LAPP: People did heave a sigh of relief, but that said, if the last many months have taught us anything, it is that the future is totally unpredictable with regard to the pandemic and what impact it will have on our campus and beyond.

HOLLISTER: Katie’s point is critical one. This is a time of enormous uncertainty and the sudden changes in the endowment are a good example. With all of the market volatility, the administration and the Corporation have said they intend to distribute as much as they responsibly can from the endowment. The Corporation took three separate actions: in May, they reduced the endowment distribution for fiscal year 2021 because the markets were trending down 25 to 30 percent at the time. They reduced the distribution by 2 percent at that point from the previous year. Then, as the markets improved in July, they increased the guidance to maintain a flat distribution as compared to the prior year. And then, finally, about a month ago due to relatively strong performance at Harvard Management Company, happily, President Bacow announced a $20M contribution, the equivalent of a 1 percent increase, from central funds available to the Schools. It’s an example of Harvard being adept and quick. At the same time, unfortunately, we’ve also had to be adept and quick in reducing expenses to offset other revenues that are rapidly declining.

GAZETTE: The endowment has been a frequent target of critics. Does this illustrate its importance and perhaps validate it as a key financial strategy?

HOLLISTER: There’s an oft-voiced perception that the endowment is somehow hidden away and unused, that it’s being hoarded, when in fact it’s the opposite. Earnings from the endowment are distributed annually without fail. They represent Harvard’s largest source of revenue for teaching and research. And, as the administration has said, the aim is to distribute as much as responsibly can be distributed to benefit both current and future generations of students and scholars. We’ve been lucky that the markets rebounded. It wasn’t too long ago, during the Great Recession, that the endowment lost almost 30 percent of its value and the distribution had to be cut nearly 20 percent over two successive years. With the current difficulties in the economy, some might say the market is overvalued, but we’ll keep our fingers crossed.

GAZETTE: Why don’t we get into more detail on COVID’s impact on the University’s finances? How did it impact operating expenses?

HOLLISTER: There was rapid action taken on all discretionary spending, as well as a salary freeze, voluntary salary reductions by University leaders, a hiring freeze, and putting the brakes on capital spending. Thanks to everyone’s efforts, it worked. Setting aside onetime charges, expenses were down almost $70 million from 2019, and down $272 million from what we thought they would likely be just a few months before the end of the fiscal year. If we had not taken those actions, that $10 million negative result would have been far worse.

GAZETTE: Amid those cuts, financial aid was able to be maintained and in fact, increased?

LAPP: For the past year, Harvard granted $645 million in financial aid and scholarships, which was an increase of $31 million, or 5 percent. Thanks to our alumni and philanthropic supporters, Harvard continues to have one of the most generous aid programs in the country, both for undergraduate and graduate students. Members of our community rose to the occasion in the middle of this pandemic and with a stock market collapse to provide more dollars in current year giving than any other year in Harvard’s history.

GAZETTE: There’s no end to the pandemic in sight. Are revenues and expenditures now balanced without having to take additional extraordinary steps?

LAPP: This is going to be a period of continually monitoring how we’re doing in addressing the virus, anticipating what might be needed, and then communicating clear and concise information to the community. No one knows what this pandemic has in store for us in the coming months — until we have the vaccine — and I think that’s something we have to live with. We have to continue to pivot and to always hold onto the values that we as a University have been and will continue to be committed to — namely, the safety of our community, advancing the mission of teaching and learning, and supporting our workforce.

HOLLISTER: We should also say that we are currently out of balance. Our projections indicate that we’re deficit spending now, and we can’t sustain that over the long term. But we’re watching it carefully. These are difficult times.

“Earnings from the endowment are distributed annually without fail. They represent Harvard’s largest source of revenue for teaching and research,” said Chief Financial Office Thomas Hollister.

Stephanie Mitchell/Harvard file photo

GAZETTE: How about the revenue side? The University gets revenue from a lot of different places. We’ve spoken about the endowment. I wonder if you could address some of the other major areas that were important in last year’s budget picture?

HOLLISTER: Katie mentioned that $270 million in anticipated revenue was lost in only 15 weeks last spring. Annualized, that is a 17 percent drop, which is eye-catching, and we’re trying to operate this year with that kind of shortfall. That’s what makes it an ongoing challenge. As one example, our most recent indication is that labs and their related funding are running at about 10 percent behind this point last year. We also expect students will need more financial aid and we know our overall enrollment is smaller, so that combination means fewer tuition dollars. Many continuing and executive education courses have been canceled or are not occurring. Fortunately, our alumni and donors really stepped to the fore, as Katie mentioned, in the spring. Going forward, however, with a difficult economy, it’s hard to count on those levels of philanthropy.

LAPP: There are also expenses for systems and processes that keep folks on campus safe: the rigorous testing, contract tracing, isolation and quarantine measures we put in place. While absolutely required to secure the safety of students, faculty, and staff, they come at a cost that has added to the stresses on our finances.

HOLLISTER: There are endless examples: Graduate students in Harvard-owned apartments were allowed to move out in the spring and break their leases. Many of those units are now unoccupied, so that’s another source of revenue that has declined, if not evaporated entirely, for a while.

GAZETTE: Some capital projects were paused, but I imagine some weren’t. A rare upside to the situation is that you can get more done if people aren’t in a building you’re renovating. What has been the impact of COVID on the progress of Harvard’s capital projects?

LAPP: We did curtail capital spending in the last few months of FY20 and the numbers reflect that. We spent $627 million compared to $903 million in fiscal year 2019. Of course, everything was paused during the pandemic’s early months, due to construction halts in Boston, Cambridge, and elsewhere, but we did later have significant projects continuing. The Science and Engineering Complex is completed. We have Swartz Hall at the Divinity School going forward; we have Lewis Hall at the Law School. There are a number of projects that were in either midstream or later, and those are proceeding. We’re doing some renewal projects as well, but we’re putting a lot of scrutiny on the expenditure of capital dollars in this fiscal year.

Some projects will continue because they are critical: lab renovations and things that are absolutely essential. But each School, every department is looking at their capital expenditures and making sure that they are top priorities for the School. Some are taking advantage of empty buildings to actually do overdue repairs and deferred maintenance: We can get in there quicker without interrupting too many people.

GAZETTE: Even before the pandemic struck, higher education was feeling an economic squeeze. How is the industry doing during these times?

LAPP: I think the pandemic accelerated a lot of changes that were on the horizon. It created a tremendous avalanche that hit many, many institutions, and those that are less financially stable are feeling tremendous strain. Having to send students home was quite dramatic, both in terms of its speed and its impact on finances. Bringing people back this fall required making sure that systems were in place to keep people safe, and Harvard relied on the guidance from our public health experts at HUHS. Having so many people working, teaching, and learning remotely put a dramatic strain on institutions without the robust systems that a place like Harvard has, thanks to the hard work of our IT teams over the years. We’ve seen some schools closing or talking about merging. We read recently about dramatic declines in student enrollment in community colleges and many small colleges. I don’t think we’ve seen the end of these impacts.

HOLLISTER: From a financial standpoint, this has exacerbated the pressures of the last decade on traditional revenues in higher education. It’s among the many challenges facing our country as a result of the pandemic, because American colleges and universities have been the source of new discoveries, new knowledge and ideas, and the training grounds for future leaders for a better tomorrow.

As we look forward, it’s probably worth mentioning two things. As dour as we have been in discussing the financial impacts of the pandemic, Harvard will find a way through this. We have the capacity and the leadership and the know-how to do it. And secondly, what’s happening at Harvard now is in some ways exciting, with faculty, scholars, and researchers finding new ways to deliver remote and hybrid learning, advancing new approaches to pedagogy, publishing new knowledge, and carrying on with consequential research. It’s happening at every Harvard School. I’d rather we didn’t have to pay such a terrible price for it, in human and economic terms, but there are some silver linings.

Interview was lightly edited for clarity and length.