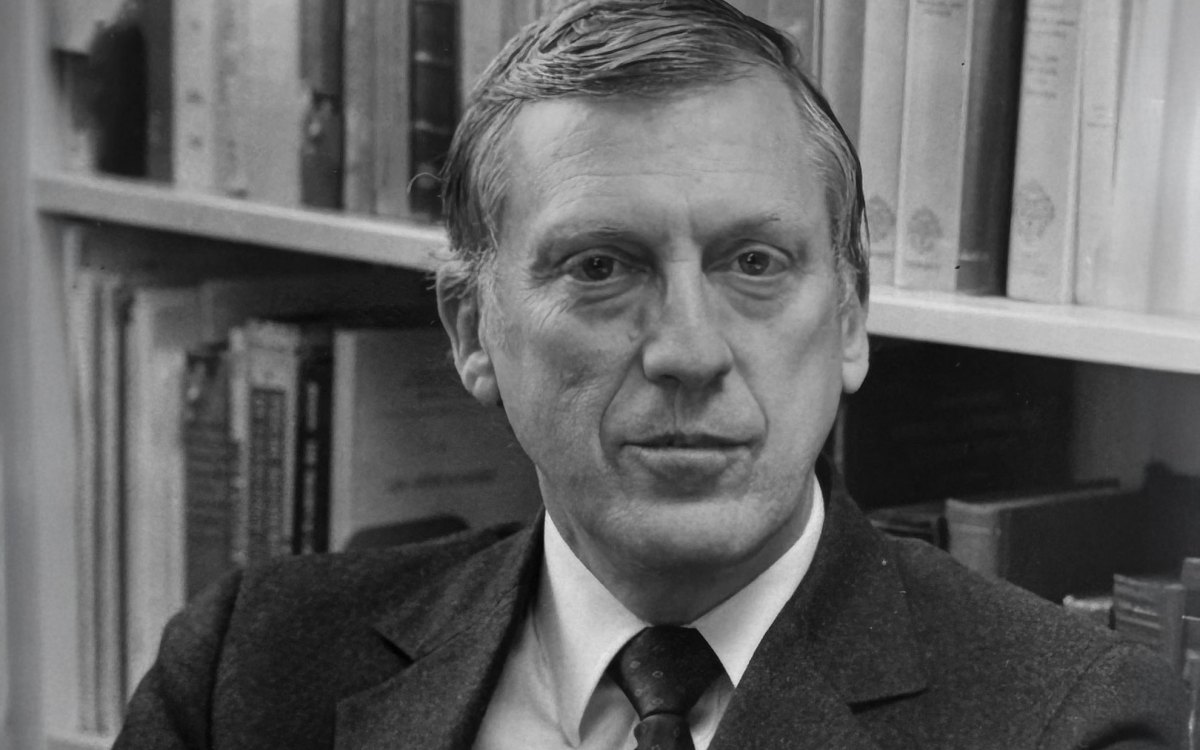

Kris Snibbe/Harvard Staff Photographer

A call to halt endowment tax

Faust among 49 college presidents signing protest letter to Congress

Leaders of 49 of the nation’s top colleges and universities on Wednesday asked Congress to repeal or amend the new tax on university endowments and other investment income. The tax was passed in December, a rare hike in the broader $1.5 trillion tax-cut package.

The letter, signed by Harvard President Drew Faust and presidents and chancellors from Amherst College to Vanderbilt University, called the tax “unprecedented and damaging” to charitable resources, and urged lawmakers to “preserve resources that would otherwise support students, teaching, and research.”

The letter was addressed to Republican and Democratic decision-makers, including Majority Leader Mitch McConnell and Minority Leader Charles Schumer in the Senate, and Speaker Paul Ryan and Minority Leader Nancy Pelosi in the House, along with the Republican chairs and top Democrats on each chambers’ tax-writing committees, including Senate Finance Committee Chair Orrin Hatch and ranking member Ron Wyden, and House Ways and Means Committee Chair Kevin Brady and ranking member Richard Neal.

In the letter, the academic leaders pointed out that endowment income is not squirreled away against financial hard times, but rather is a critical part of institutions’ budgets and is used annually to support teaching and research. Another key is use for financial aid, which improves affordability to students of all economic backgrounds.

At Harvard, about 36 percent of the budget comes from endowment income each year, supporting financial aid, faculty positions, research centers, and more.

“[The tax] will constrain the resources available to the very institutions that lead the nation in reducing, if not eliminating, the costs for low- and middle-income students, and will impede the efforts of other institutions striving to grow their endowments for this very purpose,” the letter said.

The 1.4 percent tax applies to college and university net investment income, which includes income earned from endowments as well as other investment funds. The tax is expected to raise $1.8 billion over 10 years and applies to institutions with at least 500 students and assets valued at $500,000 per full-time student.

Faust was a vocal opponent of the tax proposal in the months leading to its passage, saying then that she was “deeply concerned” at its adoption and that the University would subsequently “assess its damaging impacts.”

“The [tax] provision will constrain the resources that enable us to provide the financial aid that makes college more affordable and accessible and to undertake the inquiries that yield discoveries, cures, innovation, and economic growth,” she said in December.