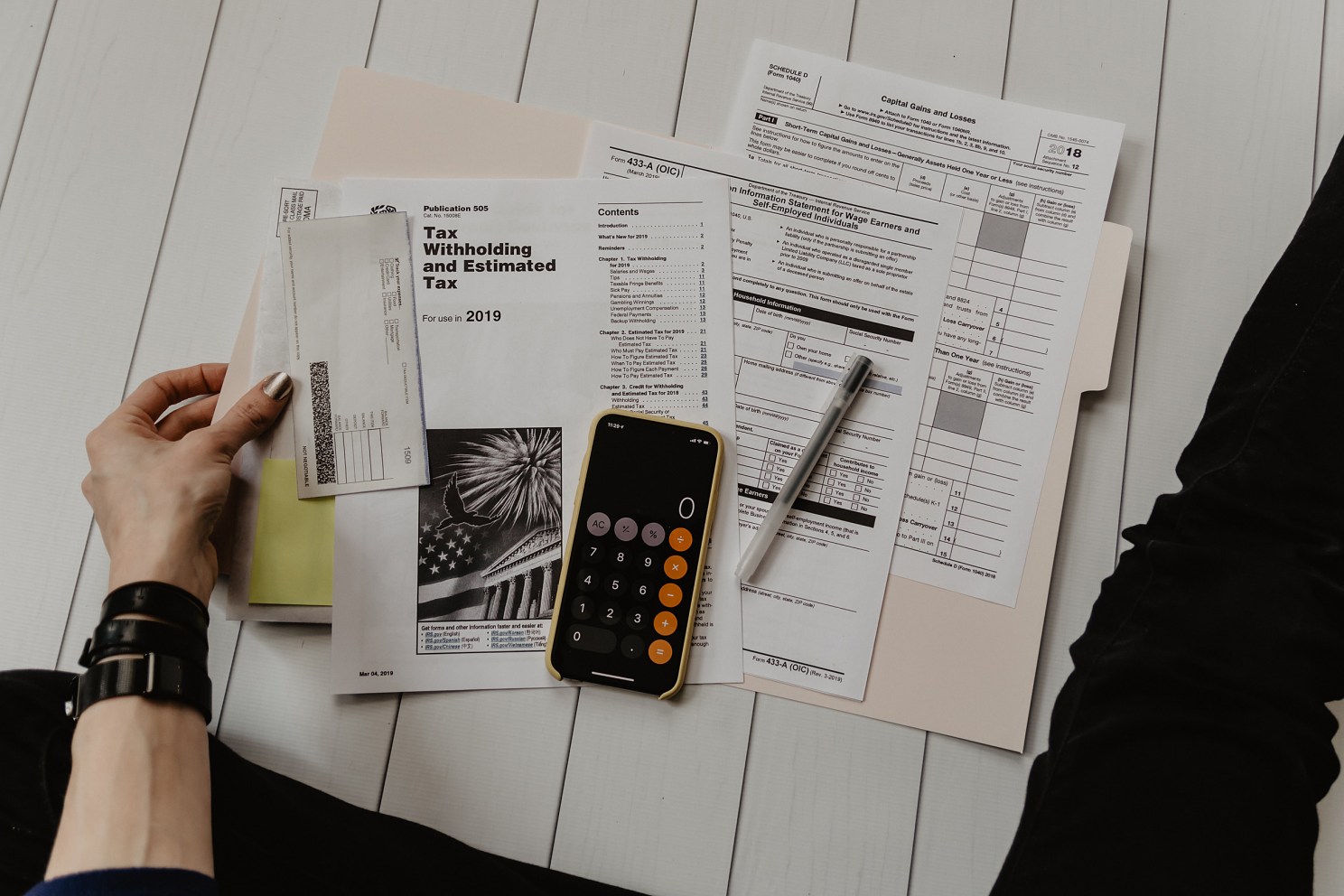

New paper examines roles of financial fragility and control in well-being

Kelly Sikkema/Unsplash

Researchers Piotr Bialowolski, Dorota Weziak-Bialowolska, and Eileen McNeely, of the Harvard Chan SHINE program, examine the roles that financial control and financial fragility play in well-being in a new paper published in the journal Social Indicators Research.

Financial fragility is recognized as a substantial issue for individual well-being. Various estimates show that between 46 and 59 percent of American adults are financially fragile and thus vulnerable in terms of their well-being.

The researchers argue that the role of financial control in shaping well-being outcomes — despite being less recognized in the literature than the role of financial fragility — is equally or even more important.

The team examined impacts of financial fragility and financial control on 17 well-being outcomes, including emotional well-being (nine outcomes), physical well-being (four outcomes), social well-being (two outcomes), in addition to an unhealthy days summary measure and the flourishing index. Financial fragility was shown to be on average less influential for the well-being outcomes than financial control.

The results suggest that financial control plays a protective role for complete well-being. Less evidence in support of a harmful role of financial fragility for well-being is provided. Tests for moderation effects revealed no interaction between financial control and financial fragility within our sample, indicating that financial control did not modify the relationship between financial fragility and well-being.