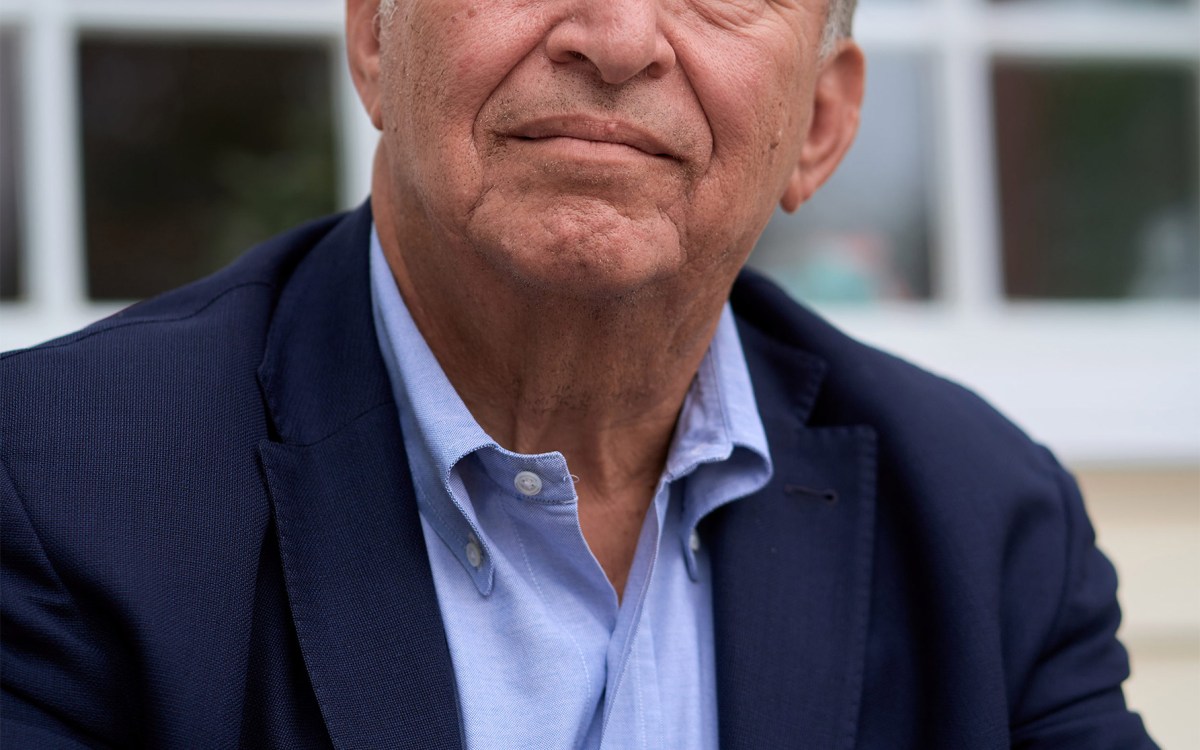

Economist Lawrence H. Summers has been supportive of the Inflation Reduction Act of 2022, saying it addresses needs while lowering inflation at a time when that has become a national priority.

Courtesy of Lawrence Summers

Larry Summers details how Senate plan will reduce inflation

Argues it will also help environment, fairness in health care, strengthen tax system

Supporters of the plan passed by the Senate over the weekend cheered the benefits they hoped it would bring in climate change and health care. But final passage was achieved only after negotiations with moderate Democratic Sens. Joe Manchin and Kyrsten Sinema that turned on questions about funding, including raising corporate taxes. Manchin also sought assurances that the bill, dubbed the Inflation Reduction Act of 2022, would not increase the deficit and rein in inflation. The bill’s architects say their final plan addresses all those concerns and potentially cuts hundreds of billions from the deficit. Economist Lawrence H. Summers, Harvard’s Charles W. Eliot University Professor, president emeritus, and former U.S. Treasury Secretary, has been supportive of the legislation, saying it addresses needs while lowering inflation at a time when that has become an important national priority. The Gazette spoke with Summers about the law, its impact on the economy and inflation, and his thoughts on its action — long-awaited — on climate change.

Q&A

Lawrence H. Summers

GAZETTE: Some have questioned whether the Inflation Reduction Act comes as billed, whether it truly would reduce inflation, and you’ve been on the record saying you believe it would. What do you like about it and why is that the case?

SUMMERS: The tendency of this bill will be to reduce inflation, because over time it reduces demand by bringing down budget deficits. I think the revenue estimates for the IRS enforcement effort — which is related to research that Natasha Sarin and I did at the Harvard Kennedy School — is substantially low. I think we will do significantly better on revenue. So number one: It will reduce deficits. Number two: We will augment the supply of key commodities, particularly in the energy sector, because of the subsidies and other support. And number three: We will bring down prices, particularly of pharmaceutical goods, by using the government’s purchasing power more effectively to procure at low costs. So, the net effect of this bill is going to be to reduce inflation, while at the same time doing very, very important things for the environment, very important things for fairness and access to health care, doing very important things in terms of strengthening the tax system by assuring that all who should pay, do pay.

GAZETTE: If you were designing just an inflation-reduction bill, would it have elements that are similar to this?

SUMMERS: Bringing down pharmaceutical prices would be a crucial thing. Achieving overall budget deficit reduction would be an important aspect, supporting a greater energy supply would be an important aspect. And there’s an agreement that is not formally part of the bill but is in association with it, to accelerate site permitting and siting and construction of pipelines, which I think is very important in terms of efficient use of infrastructure and that also has a range of environmental and safety benefits. It’s really not smart for the richest, most sophisticated country on earth to have large amounts of oil and natural gas shipped around in tanker trucks.

GAZETTE: It’s been reported that you counseled West Virginia Sen. Joe Manchin on this legislation and perhaps played a role in his decision-making. Had you been in touch with him regularly and how hard was it to convince him about the bill’s merits?

SUMMERS: I have for many years spoken frequently to many public officials in both the legislative and the executive branch and in both political parties. It’s part of how academic experts can contribute to public policy. I share my substantive views in my writings and in appearances on television and podcasts and in various other forms. And I give private advice privately, so I’ll decline to comment on the rhythm of my conversations with Senator Manchin over the last year.

GAZETTE: Is it possible to talk about how large an impact on inflation this bill might have?

SUMMERS: It’s in the right direction. By far the most important determinants of inflation are monetary policy and the cyclical behavior of the economy. So, while I think this is a step in the right direction — and therefore is a very large change from the measures that were enacted in early 2021 — I don’t think it’s a huge change. But those who are saying that a bill that achieves hundreds of billions of dollars in deficit reduction over 10 years is going to be noninflationary need to recognize that a corollary of that view is that a bill that spent close to $3 trillion in one year [on pandemic relief] was really quite inflationary.

GAZETTE: You recently put the chance of recession in the next two years at around 75 percent. Does this change that at all?

SUMMERS: The recession that I think is likely in the next two years is baked in by a combination of the overheating of the economy and the supply shocks that the economy has suffered from what’s happened in Russia and China.

GAZETTE: We last spoke in February, and there have been several interest rate increases since then. How far along are we on the road to where we need to be with interest rates?

SUMMERS: Inflation as measured by the CPI [consumer price index] is above 9 percent. That has a range of special factors included in it, but I think it’s difficult to avoid the conclusion that we’re a 4 to 5 percent inflation country. It would be very surprising if interest rates in the 2s were sufficient to bring 4 or 5 percent inflation substantially down in a durable way.

GAZETTE: Would interest rates have to be above that base inflation rate to have the effect we’re looking for?

SUMMERS: Traditionally, interest rates have had to rise above inflation in order to bring inflation under control. But there are a lot of special features of the current economy, so I would not make a confident forecast. I nonetheless would be surprised if the 3¼ percent interest rates that the market is now envisioning were sufficient.

GAZETTE: Do you endorse the aggressive pace in raising rates that the central bank has employed?

SUMMERS: Unlike the case in 2021, when I thought policy was missing the core reality of substantial and accelerating inflation, I think that policy now is in the right quadrant. I think the most difficult decisions and challenging moments are likely to lie ahead of us, because I think the economy is weaker than it was, and we’re still a substantial distance from achieving inflation objectives.

GAZETTE: At some point, will those things converge, requiring a very close call for policymakers?

SUMMERS: The judgments involved in monetary policy in the next six or nine months are going to be as difficult as any set of monetary policy judgments in many, many years. The easier judgments are when the direction is clear. During the financial crisis, it was clear that we needed to expand — how much and through what instruments were the difficult questions. In the late 1970s and early 1980s, for Paul Volcker, it was challenging, but the direction was entirely clear. The most difficult moments are when there are competing pressures from inflation, to restrain; and from slowdown, to expand. That’s what I fear we have ahead of us.

GAZETTE: What do you see as the economic impact of some of the tax pieces of this legislation, like the corporate minimum tax?

SUMMERS: The corporate minimum tax is something that I have worked on for some years. Unlike many experts, I think there is some virtue to having parallelism between profits reported for accounting purposes and for tax purposes. For tax purposes, people want to understate profits; for accounting purposes, they want to overstate profits. The two represent offsetting pressures that may drive toward more honest reporting. People are right to believe that we should have a variety of incentives in the tax code, but that companies that report profits to their shareholders very regularly and are rewarded by the stock market very regularly should pay something in taxes. That’s a legitimate feeling that public policy should respond to.

GAZETTE: Will they have a particular economic impact or are they not large enough?

SUMMERS: We’re talking about $1.4 billion a year in a $22 trillion economy. So, I don’t think those provisions will have major economic effects beyond being a step toward more economic fairness. I say that not as someone who has the philosophy that tax policy should be an instrument for tearing down the wealthiest. I think it’s important to avoid — in every sphere — envy-based policies.

GAZETTE: What do you think of the tax changes made to get Sen. Sinema aboard, which included scrapping a proposal that would have raised rates for some very wealthy taxpayers on “carried interest” income?

SUMMERS: I was sorry about the last-minute changes which reflected the success of narrow special interests against the public interest. Rarely, have I seen a public policy issue as clear as the merits of taxing carried interest at full income tax rates.

GAZETTE: Looping back to the climate aspects of the legislation: Are there prospects for long-term economic benefit, if the tax credits, subsidies, and other climate-focused steps are successful?

SUMMERS: There are some in the environmental community who speak so warmly of the benefits of climate investments that you might think that if climate didn’t exist as a problem, it would be a good idea to pretend it did so we would get the benefits of the solutions. I think that is misleading. The better paradigm for thinking about these issues is that the planet is facing existential risks, and we need to contain those existential risks as inexpensively as possible. We in the U.S. can benefit from being a leader and an exporter in the development of new technologies and new approaches. I think that this bill will help in that regard. With any challenge — from writing a term paper to saving a planet — it is easier to meet it if you begin early than if you begin late.

GAZETTE: And as far as effectiveness of the approaches — the tax credits for consumers, industry subsidies?

SUMMERS: These are very valuable experiments, and they are getting us moving in a good way. The stakes here are so high that it is definitely — as my old boss Bill Clinton used to say — “a good idea to get caught trying” and to get caught trying in a whole variety of ways. I think we will learn a great deal and there’ll be much for the environmental economists at Harvard and other places to study from the experiences of all these various subjects and these various programs.

GAZETTE: So, even though this has been billed as the biggest climate effort ever by the federal government, let’s see how these things work before we claim victory?

SUMMERS: To use Churchill’s rhetoric: This is surely not the end; it is surely not the beginning of the end. But in terms of a major national commitment of substantial resources — not just to planning but to incentivizing actual transformation — it might be the end of the beginning.