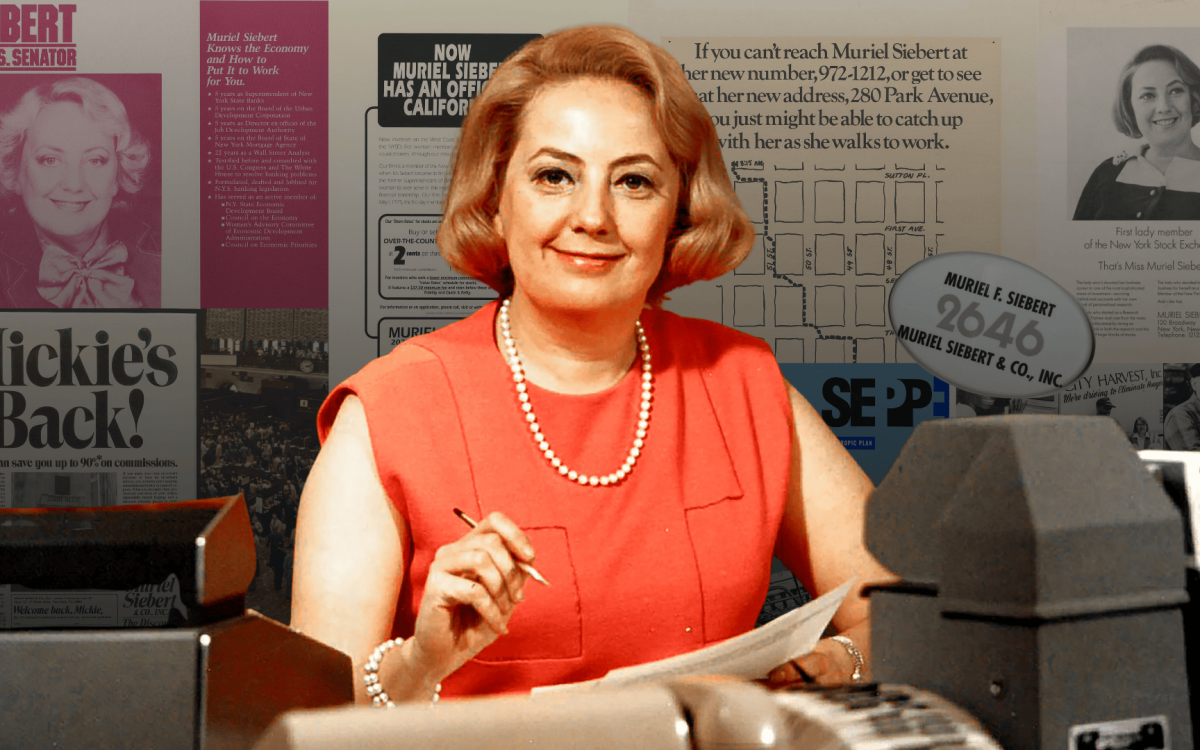

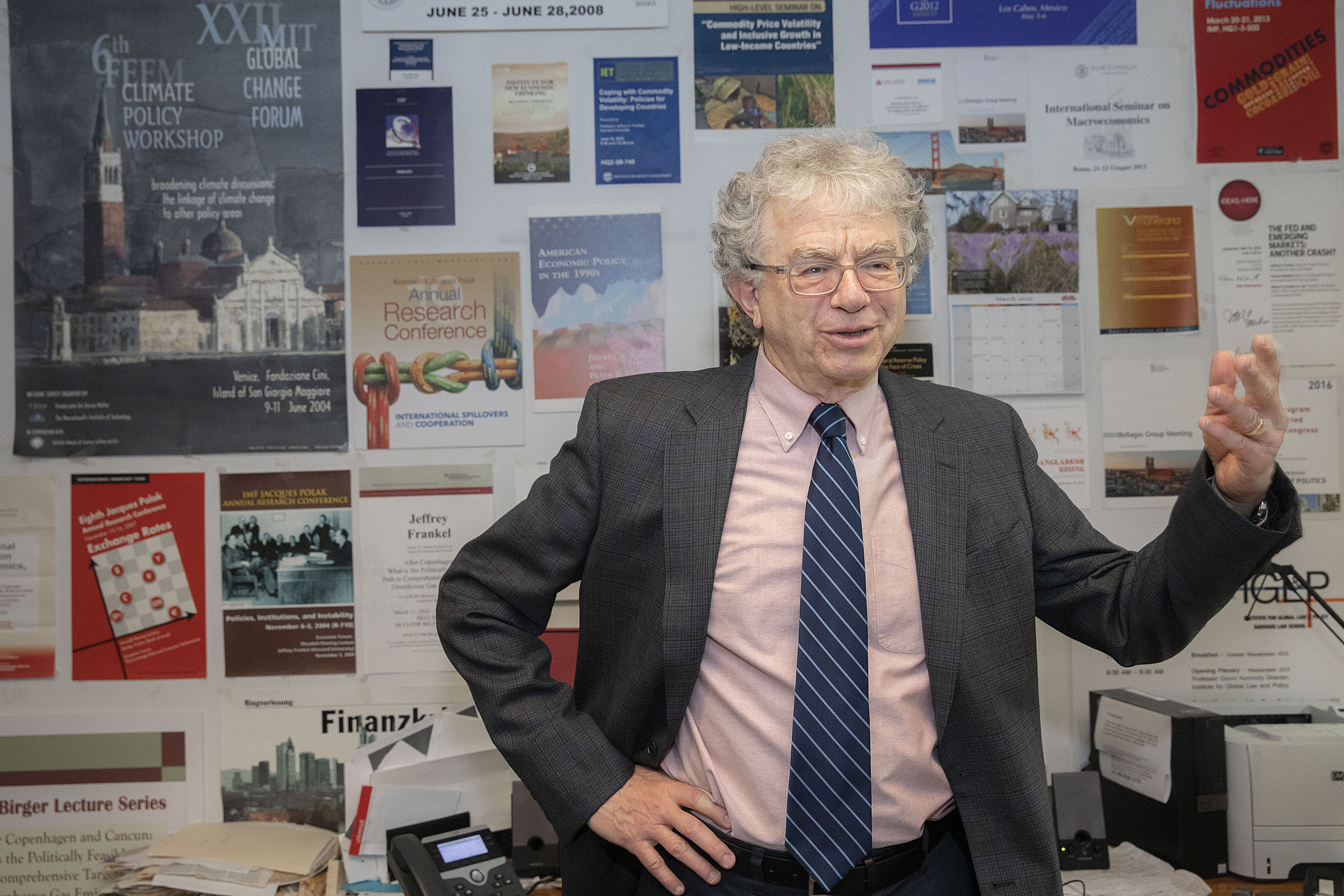

“I could say it’s like the oil shocks of the ’70s combined with the financial crisis of 2008. I’ve heard some say that it could be as bad as the Great Depression, but I think that is going too far,” says Harvard Kennedy School’s Jeffrey Frankel.

Kris Snibbe/Harvard Staff Photographer

Why odds of a coronavirus recession have risen

Jeffrey Frankel cites domino effect of problems in China, huge U.S. deficit, likely decline in jobs and spending

This is part of our Coronavirus Update series in which Harvard specialists in epidemiology, infectious disease, economics, politics, and other disciplines offer insights into what the latest developments in the COVID-19 outbreak may bring.

Throughout his career, Jeffrey Frankel, James W. Harpel Professor of Capital Formation and Growth at Harvard Kennedy School (HKS), has assiduously tried to avoid making predictions about when the next economic recession would come and how bad it could get. But on Feb. 24, when most forecasters were still optimistic about the world’s economic outlook as the coronavirus began to spread outside China, Frankel wrote an article in Project Syndicate warning that the outbreak increased the likelihood of a global downturn. The Gazette talked to Frankel about the impact of the pandemic on the U.S. economy and why he thinks it may be headed for recession.

Q&A

Jeffrey Frankel

GAZETTE: What was the outlook of the global economy before the coronavirus outbreak?

FRANKEL: As recently as a month ago, which was after the coronavirus outbreak but before people outside of China were taking it very seriously, the conventional view of the economy was optimistic. The [International Monetary Fund] was forecasting that 2020 would be a year of stronger growth compared to 2019. There had been fears of recession in 2019 because of the trade war, but recession hadn’t happened; figures for U.S. employment were still coming in strong; the U.S. stock market reached an all-time high on Feb. 19; and the VIX, the [Chicago Board Options Exchange’s] so-called fear index, a measure in the financial markets of how worried about risk people are, was very low. Investors weren’t worried about risk from the coronavirus, the trade war, or anything else.

The financial markets and the forecasters were overly optimistic. In truth there were plenty of possible things that could go wrong, like the trade war, corporate debt, and so-called tail-risk events, which are the bad events that have a small probability of happening in any given year but are pretty devastating once they happen. And once they happen, everybody says it’s a black swan that no one could possibly have anticipated. By that standard, the volatility index was too low, and the stock market was too high.

GAZETTE: But why were some forecasters still optimistic in late February, when the coronavirus was quickly spreading throughout the world?

FRANKEL: Forecasters thought the coronavirus outbreak would have some effect in China, with no widespread or long-lasting macroeconomic effects. It wasn’t really their fault, because the historical record is relatively reassuring. When you look at SARS in 2003, or for that matter natural disasters like hurricanes, what tends to happen is that it has a big negative impact on the economy where it happens and the impact is felt for one quarter. The 2003 SARS epidemic originated in China and the Chinese experienced negative growth through one quarter, but then they quickly bounced back. Consumers have pent-up demand and when the danger has passed, they go and spend. In general, the event doesn’t even show up in the statistics for GDP for the year as a whole. I don’t blame people who were optimistic in February. But very quickly, it was becoming obvious that this was going to be worse than that.

“I’m not a professional forecaster … But in this case, I sort of made an exception and said that the odds of a global recession seemed elevated. “

GAZETTE: While some were optimistic, you published an article warning that the odds of a global recession were rising dramatically because of the coronavirus. What are the odds now?

FRANKEL: The odds have gotten worse. Throughout my career I have not tried to predict when the next recession will come. I’m not a professional forecaster. I don’t think economists can really do it as a matter of principle. But in this case, I sort of made an exception and said that the odds of a global recession seemed elevated. As of a month ago, the numbers of infections and of deaths within China were greater than SARS 2003. That was number one. Number two, the world economy is much more dependent on China now than it was in 2003. China in 2003 was only 4 percent of the world economy, and now it’s 16 or 17 percent. Problems have taken place in the supply chains because intermediate products are produced in China. All it takes is one link in the chain to be broken. All this was becoming evident already three weeks ago. We also had the spread of the illness to Korea, Iran, and Italy, and soon throughout Asia and the world. China had already been vulnerable, by the way, because it had all these nonperforming loans and it was slowing down. Countries that trade with China or depend on China for inputs or those that are commodity exporters were all likely to be hit. Starting Feb. 24, we have seen the financial markets crash. Subsequently we also had a price war in the oil market.

GAZETTE: Some economists are saying that the probability of a global recession is 50 percent now. What’s your take?

FRANKEL: It’s hard to put a number on it. For one thing there’s no agreed definition of a world recession. According to a rule sometimes used by the IMF, a world recession is when the global growth rate is less than 2.5 percent. Global growth doesn’t turn negative often. It happened in the global financial crisis of 2008 and 2009. Back then, Europe, Japan, and the U.S. went into prolonged negative growth. Meanwhile, during the 2008–2009 crisis, for China a recession meant falling from 10 to 6 percent growth. The point is, because of stronger trend growth among developing countries, if you’re measuring the rate of growth of total world GDP, the criterion for a recession can’t really be negative. Hence the 2.5 percent criterion. In any case, the important point is that the probability of a global recession is certainly much higher today than it was a month or two ago.

GAZETTE: Is a falling stock market likely to trigger a recession?

FRANKEL: The stock market is not the economy and the economy is not the stock market. There are plenty of times when they move in different directions. But if the stock market is an attempt to say what is the present value of corporate profits, roughly speaking, it’s related to the economy. When the stock market is down 20 percent, as it is now, the definition of a bear market, it’s clearly responding to the immediate trigger that was the coronavirus. And, so far, the decline just reverses the big run-up that we had in the first six weeks of the year. But it can have recessionary implications because it’s another reason for people to cut back on spending. The direct effect of the coronavirus on the economy is that people are cutting back on spending and working because they’re told to stay home. As far as the stock market goes, if people feel less wealthy, consumption will fall, and firms cut their investment because the cost of capital to finance investment rises when the stock market falls.

GAZETTE: What do you think will be the major impact of coronavirus on the U.S. economy?

FRANKEL: Things have moved so fast. The last major economic statistics were the employment numbers for February, and they were fine, and that was a continuation of the 11-year expansion. We don’t yet have numbers for employment or GDP that reflect what is happening, but it’s clear that this is going to be a big hit. China is going through it first, chronologically, and then a lot of other countries, like Italy and others in Europe, are following suit. Then us.

GAZETTE: How do we know when a recession happens? What variables are involved in a recession?

FRANKEL: A recession is defined as a fall in economic activity; fall in GDP, income, employment, and output. There are two kinds of recessions, in terms of the cause: One is the result of an adverse supply shock, and the other is the result of an adverse demand shock. In an adverse supply shock, the fall in GDP is accompanied by an increase in prices; an example is the oil shocks in the 1970s. The price of oil tripled in 1974 and doubled again in 1980, and both events led to severe recessions. Those were the worst recessions that we had experienced since the 1930s. What’s going on now has some aspects of that.

What can the government do? The federal government can cut government taxes, raise government spending, or ease monetary policy, and that’s how we respond to most recessions. But that doesn’t work in the case of a supply shock because those are ways of getting people to spend more money, but the problem in a supply shock is that the firms can’t produce what’s already being ordered or bought, because the worker is staying home or because their production process is dependent on some intermediate input or part that is produced somewhere else, which has been interrupted. In this case, neither increased printing of money, lowering of interest rates, increasing government spending, or cutting taxes is going to help.

The current crisis has many aspects of a supply shock. At the same time, it also has aspects of an adverse demand shock, which is a more typical cause of recession. A prominent example of an adverse demand shock is the global financial crisis of 2008. After housing prices fell, many homeowners defaulted on their mortgages. There was a negative demand shock, with people cutting back on spending because they didn’t have the money to spend. In this type of recession, both monetary stimulus and fiscal stimulus can be useful because they give people money to spend. In 2008, the government responded with expansionary monetary and fiscal policy. At least for the first two years, that made a huge difference and prevented the global financial crisis of 2008 from becoming another Great Depression.

“We could have taken advantage of the advance warning time from watching what had been happening in other countries for the last three months, but we wasted the opportunity.”

GAZETTE: Are we headed for a recession?

FRANKEL: As I mentioned, I’ve never tried to forecast the timing of a recession. The only reason why economists do it is because they keep being asked to do it [laughs]. But I would say that the odds of worldwide recession are pretty high. The odds of a sharply negative quarter or two, in terms of growth in the U.S., are also pretty high — higher than any other time I have ever felt comfortable predicting. The optimistic scenario is that the cycle of the coronavirus infections will follow the pattern that it has followed in China, which was to peak after a couple of months and come back down, and, hopefully, stay down. But the economic effects are going to be deep. I think it will probably qualify as a U.S. recession.

GAZETTE: How effective are the latest actions by the U.S. government, including Sunday’s announcement by the Federal Reserve to cut interest rates to near zero?

FRANKEL: The more important policy measures are the response to the supply shock, which is in this case means public health measures. So far, we have failed on that front. We could have taken advantage of the advance warning time from watching what had been happening in other countries for the last three months, but we wasted the opportunity. In terms of fiscal policy, the White House proposed a solution, which was a tax cut, which is their solution to everything. If we get invaded by Martians, their solution would be a tax cut [laughs]. The targeted legislation that was negotiated by House Speaker Nancy Pelosi and Treasury Secretary Steve Mnuchin was the right thing to do, including provisions for paid sick leave, free testing, extension of unemployment insurance and food stamps. But the most important provision is funding for public health. The lack of preparedness in public health was tragic because such a pandemic was foreseen by the experts, who were screaming as loud as they could before any of this happened that we were not prepared. This current administration eliminated the unit at the National Security Council that had been set up to deal with pandemics and sought to cut sharply the budget for the Centers for Disease Control [and Prevention] in Atlanta. And that obliviousness helps explain why we’re less well-prepared than most advanced countries; we don’t have enough testing kits, ventilators, or hospital beds.

“Experts warned about the possibility of terrorists bringing down tall buildings. Same thing happened with the possibility of a housing price crash in 2007. Similarly, experts in epidemiology had been warning about a pandemic for years.”

GAZETTE: Is there something U.S. citizens can do to protect themselves from the economic impact of coronavirus?

FRANKEL: Even if people are tired of hearing it, we should remind them to wash their hands, not shake hands, and stay out of crowds. If everyone can do those things, that will do a lot to reduce the threat, both the health threat and, for that matter, the ultimate economic danger. As for an individual economic response, it’s too late for the advice not to put all your savings into stocks.

GAZETTE: Is this crisis going to be as bad as the 2008 financial crisis?

FRANKEL: I could say it’s like the oil shocks of the ’70s combined with the financial crisis of 2008. I’ve heard some say that it could be as bad as the Great Depression, but I think that is going too far. I’ve heard the opposite case made as well, that six months from now, we’ll be past the worst of the crisis. I don’t know. But it is a serious crisis. And it was to some extent unnecessary. So many of these things were warned about ahead of time, including the fact that we were already running a trillion-dollar budget deficit, which may now inhibit Senate action on fiscal stimulus. [The period of] 2018–19 was the first time outside of wartime that the U.S. has ever run so big a fiscal deficit when the economy was at its peak. This was risky because when you have a recession, as we probably are having now, it reduces the amount of fiscal space you have to increase spending and cut taxes. Or that Congress thinks it has.

GAZETTE: Can you talk a bit more about historical parallels you see?

FRANKEL: I see certain parallels between the coronavirus crisis and the 2008 financial crisis and the 2001 Sept. 11 terrorist attack. In each case, leaders said, “Who could have imagined that such a thing was possible?” Donald Trump complains of having to deal with a pandemic which “nobody ever thought would be a problem.” Before the global financial crisis, plenty of people said, “Housing prices can’t go down.” And after Sept. 11 happened, National Security Adviser Condoleezza Rice said that no one could have imagined that someone would fly a plane into the World Trade Center. In each case, there were experts who had written memos and reports about precisely those possibilities, but the messages didn’t get through. Experts warned about the possibility of terrorists bringing down tall buildings. Same thing happened with the possibility of a housing price crash in 2007. Similarly, experts in epidemiology had been warning about a pandemic for years. They were ignored. Some people say, “Who cares about what the experts think?” But on each of these subjects, they got it right, and we paid in each case a high price for not listening.

This interview has been edited and condensed for length and clarity.