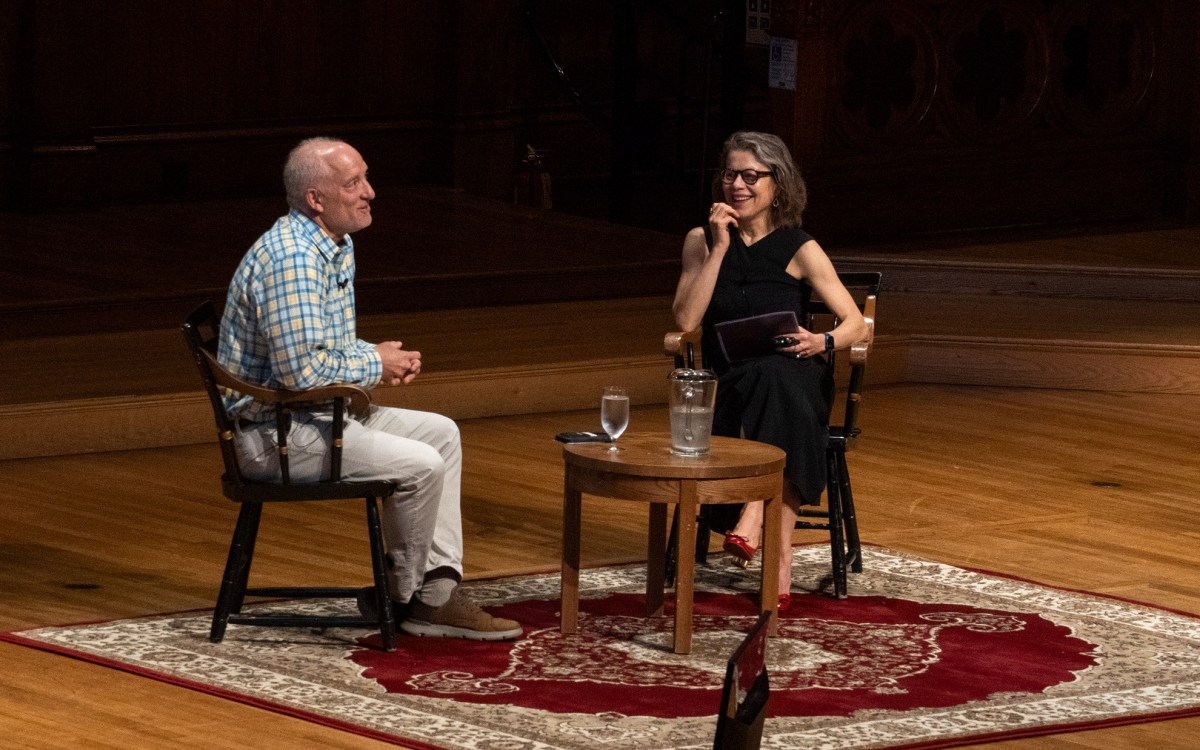

Precious Eboigbe ’07 (right), now a second-year law student at Boston College, said that with the Harvard Financial Aid Initiative, “I was definitely less concerned about money.” Eboigbe spent three years as an HFAI student coordinator whose job, in part, included mailing the letters of admission.

File photo Stephanie Mitchell/Harvard Staff Photographer

A Harvard education, without worry

For 10 years, enhanced aid has allowed students in need to attend the College and graduate debt-free

In the fall of 2003, William R. Fitzsimmons, Harvard’s dean of admissions and financial aid, visited Austin, Texas, on a recruiting trip. After Fitzsimmons spoke, the parent of a prospective student stood up. “Harvard sounds wonderful,” the man said. “But I can send my daughter to the University of Texas for a third of the cost or less.”

Fitzsimmons and other Harvard officials already were steeped in the latest research, which said that college was getting too pricey for average Americans. But the question still shook Fitzsimmons, who knew that Harvard, despite providing rising financial aid, was still depriving itself of talented students whose families were strapped for cash — and whose economic diversity could provide a social benefit.

“We were concerned about the whole idea of upstairs and downstairs,” he said in an interview. Admissions officials were worried that colleges once again would come to mirror the nation’s economic disparities, and that Harvard in particular “would go back to the old days, when we were mostly a bastion for the affluent.”

There was also concern that students saddled by debt and constant worry had to work long hours during the school year, and so “were not getting the full Harvard experience,” said Fitzsimmons.

The sting was personal. As a Harvard freshman in 1963, Fitzsimmons had come from a working-class family in Weymouth, Mass., and earned pocket money by pumping gas. Travel was a marker of his socio-economic class back then. The young Fitzsimmons had only gone as far south as New York City and as far west as Niagara Falls. He had gotten the idea of attending Harvard by reading an encyclopedia entry.

In 2003, Fitzsimmons knew that the man from Austin, who was of modest means, was right. Although Harvard awarded its first scholarship in 1643, it was still, centuries later, a place that often only the well off could afford. Without “revolutionary changes in our financial aid program,” he remembers thinking, “we certainly would be less and less relevant.”

Returning to Cambridge, Fitzsimmons and two other officials spent the following weekend sketching out solutions. One was Sally Donahue, director of financial aid and senior admissions officer. The other was Clayton Spencer, policy adviser to then-Harvard President Lawrence Summers and now president of Bates College. By Monday, all three returned with drafts of financial aid plans that were strikingly similar.

“Larry, as an economist, understood instinctively the issue of waste — wasting human talent and human capital,” said Fitzsimmons of Summers, an early backer of broadening financial aid.

Good timing

The time was right. In the previous six years, Harvard had boosted its student aid by 49 percent. And in December 2003, Harvard had announced the formation of the Crimson Summer Academy, a program for low-income high school students eager for Harvard summer study and for college advisement.

Not long after the Texas visit, the outline took shape of the Harvard Financial Aid Initiative (HFAI), a plan to make the College more accessible to low- and moderate-income students. Harvard would step up recruitment; it would make college free for students from families earning less than $40,000; and it would trim parental contributions from households earning less than $60,000. (Income cutoffs today are higher, for which Fitzsimmons praised President Drew Faust.)

Harvard announced HFAI on Feb. 27, 2004, 10 years ago this month. It went into effect that September. The changes in 2004 added about $2 million in costs to the College’s $80 million annual scholarship budget, and quickly benefited about 1,000 students.

Patricia “Patty” Rincon ’08, the daughter of Mexican immigrants in California, was a freshman that fall, and one of the first beneficiaries of the expanded aid plan that insiders now call “H-Fi.” She had been accepted at Stanford and into the University of California system, “but I would still have to take out a lot of loans, substantial loans I would still be paying back,” said Rincon, now a second-year law student at the University of Oregon. So the financial aid letter from Harvard came as a shock. Her family’s tab for four years of college would be zero.

Back then, said Fitzsimmons, financial aid that generous “was revolutionary for places like Harvard.”

In 2003, the last year before HFAI, Harvard parents earning less than $40,000 a year paid an average of $2,300 a year towards tuition, a lot more than zero.

Enhanced financial aid eventually had meaning “not just for Harvard,” said Fitzsimmons, since Yale University followed suit the next year with a similar program, as did other schools. “It made a lot of colleges reassess where they were going,” he said. “This was not a competitive move against our peer private institutions. It was a public-policy initiative.”

HFAI “is a program that’s been instructive to other schools,” Donahue agreed.

The lesson goes bigger too, said Fitzsimmons. Democratizing access offers advantages for elite universities, he said, as well as for “higher education, for America, and for the world.”

Social advantages

Having students of modest means is a social advantage, said Donahue. “They improve the classroom experience” for those Harvard students who may not have seen economic diversity. They embody the pluck and talent that can arise from families lacking financial resources. Such students, Fitzsimmons said, better represent what America looks like demographically. It’s an education in reality for future leaders.

Outside the classroom, Donahue added, economic diversity improves the “life discussions” that thread informally through all of College life.

“All of these rich experiences,” she said, often reflect upbringings that were solidly modest. In the last decade, parents of Harvard students have been farmers and factory workers from the Midwest, fishermen in Alaska, secretaries, cafeteria workers, and laundromat managers.

When she applied to Harvard, Paris Woods ’06, Ed.M. ’08, was living in St. Louis, the daughter of a single mother who worked as a secretary. Without HFAI-level financial aid, she said, “it would have not been possible for me to go to college.” Woods graduated debt-free, which allowed her to take a first job that paid only $15,000 a year. “All of my jobs after Harvard had to do with educational opportunity,” she said. “All are focused on college access. It’s worked its way into my values.” Woods is now an admissions counselor at Cohen College Prep High, a New Orleans charter school.

Precious Eboigbe ’07, now a second-year law student at Boston College, left Harvard with the same focus: that higher education should be available to all.

“It’s something that’s always been really important to me — access,” she said, and that same drive applies to her future career in the law. “That’s a thing I have carried with me,” she said. In college, she was a four-year fencer, spent three years as an HFAI student coordinator, and three years after Harvard co-directing HFAI itself.

Eboigbe entered Harvard knowing the sharp end of the stick, financially. She was born in Nigeria and moved to New Jersey with her mother at age 2. Her stepfather died when she was still in high school. With HFAI, she said, “I was definitely less concerned about money.”

“Harvard as possible”

Muriel Payan ’08 was the daughter of a single mother who worked at a Costco in Southern California when she entered Harvard in the first year of HFAI. She graduated nearly debt-free, with $2,000 in loans. Payan now has a Wharton School M.B.A. and works in marketing at Ford Motor Co.

Harvard admissions is not only need blind, it is passport blind. Part of the economic and ethnic diversity at the College comes from international students, who make up about 12 percent of the undergraduate population. Some of them are from countries where poverty is endemic, like Kenya or India, said Donahue. “It’s very difficult for high-achieving applicants from those countries to even think of Harvard as possible.”

Today, because of HFAI, 20 percent of student families pay nothing, a “zero parental contribution,” in the language of admissions. (In 2006, the payment cutoff went up to $60,000; in 2012, it was raised to $65,000.) About 70 percent of Harvard undergraduates receive some kind of need-based aid. Families earning between $60,000 and $80,000 qualify under HFAI for reduced parental contributions.

Harvard’s financial aid program asks families earning up to $150,000 a year to pay from zero to 10 percent of their income for college expenses. (Families with incomes above that pay proportionately more.) “These are not rich people,” said Fitzsimmons of families even at the $150,000 mark. They may have more than one child in college at a time, or care for elderly grandparents, or face other financial pressures — “the struggles of real people.”

To help ease concerns for middle-class families, home equity and retirement assets are left out of financial aid assessments at the College. No one is required to take out a loan.

In the end, the average Harvard family receiving financial aid pays $12,000 a year for tuition, room, and board. Admissions officials calculate that 90 percent of American families would pay the same or less for a Harvard education as for a state school.

“Now we can go to Texas,” said Fitzsimmons, and show how things are different. “It puts Harvard on a level playing field with our great public universities.”

One line on the Harvard admissions website sums up today’s financial aid. It’s a sentence as vivid as a poem. “This is simple: Anyone can afford Harvard.”

Harvard’s broadened financial aid programs were not slowed down by the last recession. In 2007, the year before the global financial crisis, Faust and Dean Michael D. Smith of the Faculty of Arts and Sciences (FAS) launched an initiative to support students from middle-income backgrounds. Since then, funding at the College for financial aid has increased by 88 percent, to a budgeted $182 million.

“I’ve never been prouder of Harvard and its leaders than when they maintained the financial aid program in the face of the economic meltdown,” Fitzsimmons said.

Last fall, FAS announced a $2.5 billion capital-campaign drive. Of its six goals, the largest, at $600 million, is for financial aid.

This broad focus on financial aid means that every Harvard student has the opportunity to graduate debt-free, just as Rincon did. “HFAI gave me the freedom to do what I wanted to do,” she said.

“My family would never be able to afford college without it,” Jasmine Burnett ’16 said of HFAI. “It’s a weight off my shoulders.” Burnett is a government concentrator who attended Atlanta public schools.

As a freshman in 2012, Burnett was one of 275 in her class from families with incomes below $65,000; 122 more families that year qualified for HFAI reductions in parental contributions. For freshmen entering in 2013, those numbers went up: 287 families paid zero, and 144 paid reduced contributions. The Class of 2017 has 431 HFAI recipients, more than any other entering freshman class in the last decade.

“It’s freeing,” said Burnett, adding, “but I still have financial needs.” So she works up to 10 hours a week as one of six student coordinators doing outreach for HFAI.

“When you’re in college, every small expenditure can feel overwhelming,” said Rachel Culley ’07, who qualified for HFAI reduction and who grew up on a back-to-the-land homestead in central Maine. “I wouldn’t have been able to go to Harvard if my parents had to take on massive debt.” Culley, now a law clerk in Brooklyn, wrote her senior thesis on “the money taboo,” the social limits of saying how much you have.

Peter Conti-Brown ’05 grew up in a cash-strapped, seven-child household in Oklahoma. He felt the weight of arriving with little money in a place where so many had so much. In freshman year, he agreed to share the purchase of a couch with his four roommates — and was shocked to find that his share came to $120, which was all he had saved. That he had come to College with so little money “didn’t compute” to his roommates, recalled Conti-Brown, who eventually graduated from Stanford Law School, co-edited a book, authored another, and is a Ph.D. candidate in history at Princeton University.

From generous to amazing

Conti-Brown provided a sort of corrective to the HFAI success story. Even before 2004, “Harvard financial aid was already extremely generous,” he said of the $2,500 a year he and his schoolteacher mother were asked to pay. “I felt nothing but gratitude at the time. I felt nothing but love for Harvard financial aid.”

Eboigbe, the Boston College law student, said the same of her financial aid before and after HFAI: “It was so generous.”

Conti-Brown had a job in Widener Library, got money for books from a special fund, and qualified for free cultural tickets through the Student Events Fund. Harvard even “bought me a winter coat,” he said. (The Coat Fund, an artifact of Civil War-era Harvard, still exists for students in need.) He also worked odd jobs. One elderly woman paid him $50 for moving plants around her house once a month.

But Conti-Brown said the real story is that Harvard financial aid got even better. He even had a role in making it so. In the fall of 2003, when Fitzsimmons and others were devising the future HFAI, Conti-Brown was invited to a focus group on features of the proposed plan. He was a junior then, having taken two years off after his freshman year to be a Mormon missionary. In February 2004, just before the HFAI launch, he became Harvard’s representative voice and face for students of modest means.

He was quoted in The New York Times and other newspapers, and made a speech to donors. By the fall of 2004, said Conti-Brown, “I remember thinking: I can’t believe I’m going to Harvard for free.”

He became the first student director of HFAI, and traveled all over the country to speak to low- and middle-income high school students, “explaining that Harvard was within financial reach. We were telling them: It’s cheaper for you to go to Harvard than it is to go to your local junior college.”

That year, his last at Harvard, he telephoned about 3,000 prospective students, getting their names by processing a combination of financially pressed ZIP codes, census data on income, and S.A.T. scores.

Still, Harvard’s financial aid gave him more than money, said Conti-Brown, repeating a sentiment heard from many HFAI graduates. “It gave me complete confidence, with the realization: I can play on this stage.”

To this day, he added, “HFAI stands out as a great shining light.”