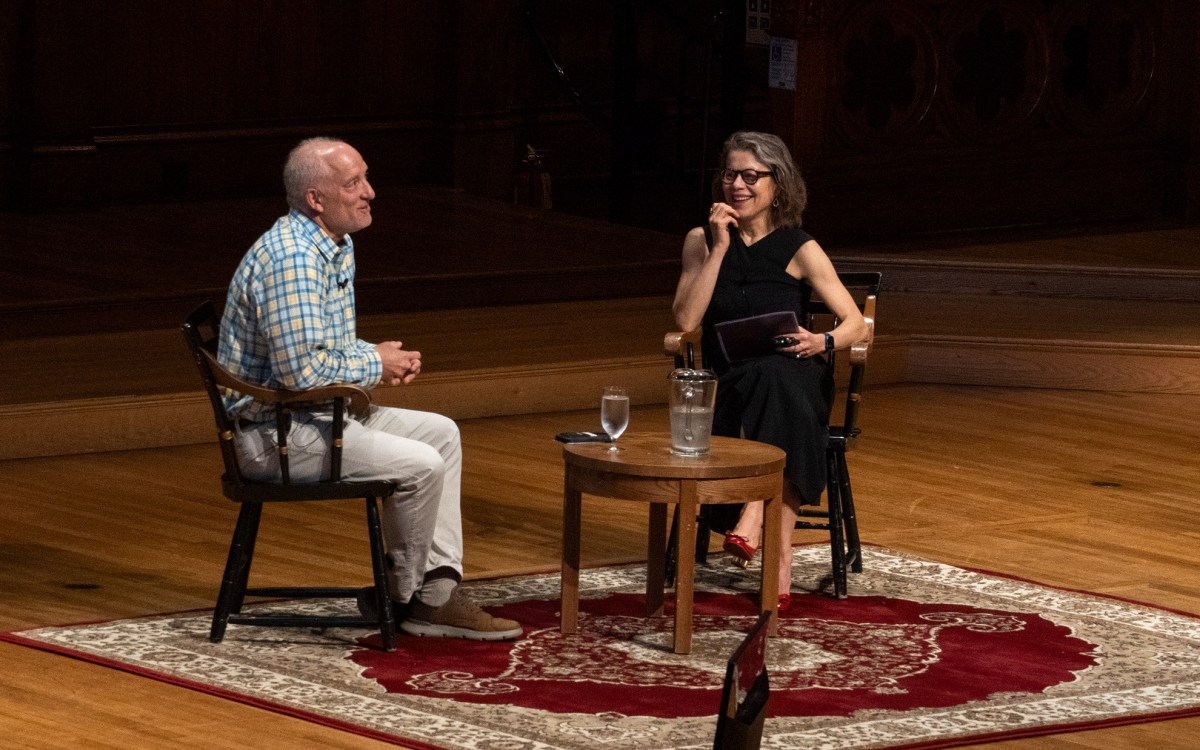

Stephen Blyth (left) and Jane Mendillo were part of the Harvard Management Company team that met with specialists from Harvard’s academic departments during “China Day.”

Stephanie Mitchell/Harvard Staff Photographer

Understanding China

Harvard investment managers meet with academicians to gain business, cultural insights

Specialists from Harvard’s academic departments spent a day with Harvard Management Company (HMC) fund managers, who oversee investment of the University’s endowment and pension funds, to provide an overview of one of the biggest emerging markets: China.

Dubbed “China Day,” the December session was organized by HMC to take advantage of the expertise in the broader University. HMC President Jane Mendillo opened the event, saying that China not only plays an important role in the global economy, it is also increasingly important in Harvard’s investment portfolio.

“As a global investor, HMC continually explores investment opportunities beyond traditional markets across our portfolio, and we are convinced that continuing to develop a sophisticated investment strategy in China will give us an important edge going forward,” Mendillo said. “HMC is committed to deepening our understanding of, and expertise in, this critical market.”

The event featured 22 speakers, including Chinese Vice Minister of Commerce Fu Ziying, a visiting fellow at the Harvard Kennedy School this year. Also included were representatives from private capital and investment banking firms and faculty members or fellows from Harvard, Yale University, Peking University, Northwestern University, and the Massachusetts Institute of Technology.

Harvard speakers included William Kirby, former dean of the Faculty of Arts and Sciences and chairman of the Harvard China Fund, who is also the Chang Professor of China Studies and the Spangler Family Professor of Business Administration; former Harvard Business School Dean Jay Light, the Baker Professor of Administration Emeritus and an HMC director; William Alford, the Stimson Professor of Law and director of the East Asian Legal Studies Program; and Richard Cooper, Boas Professor of International Economics.

Alford, who chaired one of the event’s panels, said the whole day was very thoughtful and open. He was particularly impressed at the presentations by Chinese officials who gave particularly frank descriptions of their country, presenting both good and bad.

“They were very thoughtful, forthcoming, and fair,” Alford said.

Alford’s panel discussed mega-trends in Chinese society, such as the migration of millions from rural areas to the cities and the industrialized south. A major question, he said, is whether Chinese legal and political institutions will be able to meet their needs and answer those with legitimate grievances well enough to keep conflict off the streets.

Alford hadn’t dealt with HMC before the event, but said he’s thankful for HMC’s work and its impact on Harvard’s academic programs.

“I’m really grateful for what they do. It makes possible what we do,” Alford said.

Andrew Wiltshire, HMC’s managing director and head of external management, said the day was informative and highlighted both the risks and opportunities in the world’s largest nation.

“The opportunity set there is greater and rather more complex than I had imagined,” Wiltshire said.

Stephen Blyth, also a managing director and HMC’s head of internal management, said the day was packed with speakers from a range of fields and highlighted not only what’s going on in China today, but also the breadth of Harvard’s connections with the nation.

Blyth took away a similar message, saying the session increased his understanding of how complex China is. One cautionary note, Blyth said, is that China treats contracts and business law differently than the United States does, so any investor needs to do much more work to ensure that the terms and rules of any potential transaction are clear.

In addition, information flows are not as transparent as in Western industrialized nations, so outsiders have to consider whether risks might be understated or growth projections too generous.

Blyth said the event was valuable in that it was nuanced, presenting the good, the bad, and the in-between about China’s economy, history, and business climate.

In his lunchtime keynote address, Stephen Roach, the nonexecutive chairman of Morgan Stanley Asia and senior fellow at Yale’s Jackson Institute for Global Affairs, talked about China’s transition to a consumer-driven economy and the challenges of sustaining growth and maintaining social stability.

Mendillo said there might be future sessions in which HMC taps the expertise of the University community in a particular area or industry sector.

“Obviously, there are so many brilliant minds at the University. To bring the academic viewpoint and the investment viewpoint together was very powerful,” said Mendillo.