$5 million grant from Gates Foundation to fund Financial Access Initiative

Finding funding is a key step in building the wealth of low-income individuals in developing countries. How to make that step, however, is not always clear. The anecdotal success stories about microfinance are well known; substantive research on how to increase and improve access is still lacking.

Now, a five-year Financial Access Initiative, funded by a $5 million grant from the Bill & Melinda Gates Foundation, will bring together top researchers from Harvard University, New York University (NYU), Yale University, and Innovations for Poverty Action to assess existing research on global financial access, generate new evidence through fieldwork, and inform regulatory policy.

“As donors in this space, it is critical that we make decisions informed by sound research,” says Bob Christen, director of financial services for the poor at the Bill & Melinda Gates Foundation. “We hope that the Financial Access Initiative will yield data, analysis, and research that decision makers need to deliver financial services that markedly advance the well-being of the poor.”

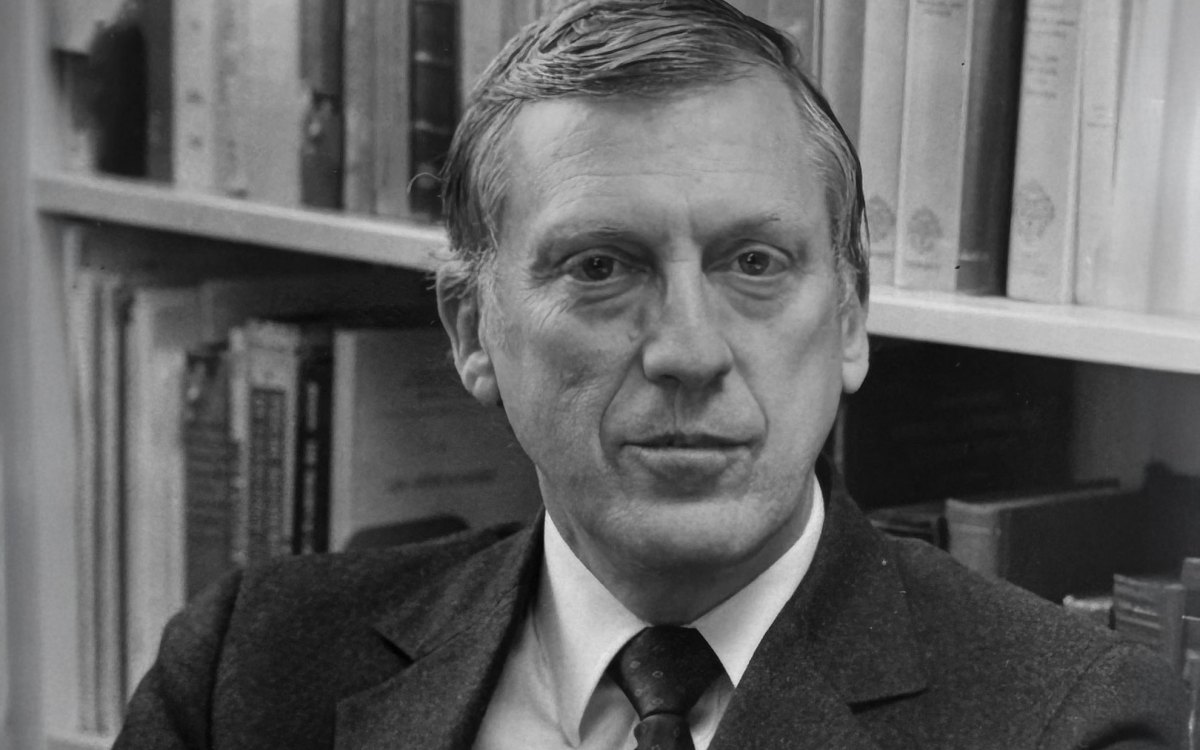

Co-directing the initiative will be professors of economics Sendhil Mullainathan, of Harvard’s Faculty of Arts and Sciences, Jonathan Morduch of NYU, and Dean Karlan of Yale. The initiative is based at NYU’s Robert F. Wagner Graduate School of Public Service. Christina Barrineau, who formerly headed the International Year of Microcredit for the United Nations, will lead the initiative as managing director.

“The Financial Access Initiative is unique in that it is a research-based program, but the ultimate goal is policy change. My colleagues and I are collecting data that will have an impact on key decision makers, as well as suggesting and creating a policy framework in order to open up access to important financial services to poor households around the world,” says Mullainathan.

Mullainathan has worked extensively with microfinance in India through the Centre for Micro Finance, part of the Institute for Financial Management and Research. There, he has worked to evaluate the impact of existing program designs and to understand which financial services can be provided cost-effectively.

One of the biggest hurdles to opening up financial sectors to those living in poverty is a lack of hard data and analysis about how poor households manage their finances and cope with risk: which financial products do the poor use and why, who has access to what, at what cost, and where. The impact of regulation and government policy on the broad availability of finance is not well understood.

Most fundamentally, despite the anecdotes, rigorous evidence is lacking on the economic and social impacts of different interventions and policies. While microfinance is the focus of much of the current work in financial access, the Financial Access Initiative will also investigate how savings accounts can improve the financial situations of poor individuals.