Harvard endowment beats benchmarks, value declines

Harvard University’s endowment beat investment benchmarks in eight of 11 asset classes in the fiscal year ending June 30, 2001, but saw its overall value fall amid broader market declines.

Investment returns fell 2.7 percent for the year, while the endowment’s overall value fell to $18.3 billion. Also contributing to the endowment’s decline was the annual payout of endowment funds for University programs. At June 30, 2000, the endowment’s overall value was $19.1 billion.

Five-year performance remained strong. Harvard’s endowment has averaged a 16.9 percent return and outperformed the median institutional fund – as measured by the Trust Universe Comparison Service – by 5.9 percent. That 16.9 percent return over five years translates to $10.5 billion in endowment income over that time.

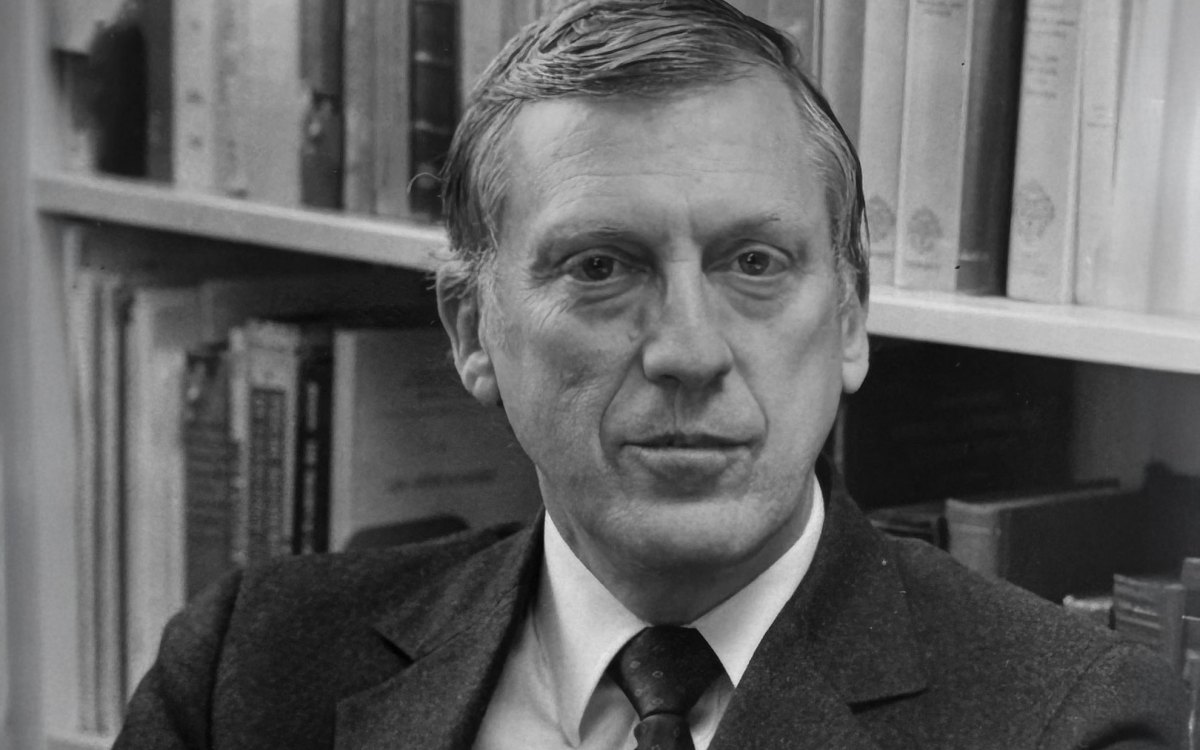

Harvard Management Company President and Chief Executive Officer Jack Meyer said fiscal 2001’s returns show the importance of taking a long view on endowment investments, which are intended to provide stability for University finances over a long period of time.

“Returns over the past 10 years have been sufficiently strong to provide a cushion against an extended rainy day,” Meyer said in his annual “John Harvard” letter to University officials detailing endowment performance. “We remain confident in the ultimate resilience of both our economy and our financial markets.”

In 2001, the endowment continued its recent trend of outperforming performance benchmarks. While returns on the endowment were negative 2.7 percent, this compares favorably with the overall benchmark, the Policy Portfolio, which fell 9.8 percent. The 2.7 percent drop also compares favorably to the median institutional fund, which fell 5.7 percent, as measured by the Trust Universe Comparison Service.

“Strong relative performance saved the day,” Meyer said. “If we had not outperformed the benchmark by 7 percentage points, it would have been a deeply disappointing year.”

As in the broader market, funds invested in equities declined during the year, while investments in bonds, real estate, and commodities buoyed the year’s results. Asset classes that rose in fiscal 2001 include domestic bonds, up 19.1 percent; foreign bonds, up 13.2 percent; inflation-indexed bonds, up 13.3 percent; and real estate, which rose 10.2 percent.

This is the first year since fiscal 1991 that the endowment’s overall value declined and the first time since 1984 that endowment investments have lost money. Factors other than investment earnings affect the endowment’s value, such as new contributions and payout for University programs.

Harvard’s endowment is the result of gifts to the University over time as well as investment income from those gifts.

Endowment income provides critical long-term financial stability for Harvard’s academic programs. Historically, between 4 percent and 5 percent of the endowment is spent annually on Harvard programs. Endowment income made up about $615 million of Harvard’s roughly $2 billion operating budget in FY01. That money provides for the specific activities that donors have endowed over time including financial aid, faculty salaries, and facilities maintenance.

Among other things, endowment income supports Harvard’s generous student financial aid programs, which permit the University to admit qualified students regardless of their ability to pay.

The endowment is not a single fund, but more than 8,600 individual funds, many of them restricted to specific uses – such as support of a research center or the creation of a professorship in a specific subject. The funds are invested by the Harvard Management Company (HMC), established in 1974 to oversee the University’s endowment, its pension and trust funds, and other investments.

Each school within the University uses a combination of income from investments, gifts from fundraising efforts, and tuition to cover the cost of educating students. Tuition from Harvard College, for instance, covers only about two-thirds of the total cost of a Harvard education. Harvard’s reliance on support from its endowment has increased in recent years. Ten years ago, the endowment provided 17 percent of Harvard’s operating budget. Today that figure is about 30 percent.